Political uncertainty and over-reliance on external borrowing make the country more vulnerable than lower-rated sovereigns.

Political uncertainty and over-reliance on external borrowing make the country more vulnerable than lower-rated sovereigns.

Kashagan-oil-field-Kazakhstan-R-780Kashagan oilfield: a new dawn thanks to rising oil prices, but what’s on the horizon as the risk score falls?

Kazakhstan’s economy stepped up a gear in 2017, growing by 4% in real terms after two years expanding by little more than 1% per annum thanks to the negative oil shock.

With oil prices touching $80 per barrel this week, optimism is returning to leading oil exporters, aided in Kazakhstan’s case by a partisan local media painting an exclusively glossy image to potential investors.

Oil and mineral production is increasing and export growth is improving the current-account deficit, which more than halved to 2.9% of GDP in 2017.

The country is rapidly developing its financial markets and the government is partially privatizing assets, including several larger enterprises slated for divestment this year – or in 2019 – such as national airline Air Astana, KazMunayGas (petroleum) and Kazatomprom (nuclear power).

Meanwhile, exchange-rate stability is helping tame annual inflation. It rose to almost 18% in mid-2016 after devaluation, but is now down to 6.5% as of April.

Invariably, these trends have improved the country’s economic risk profile.

However, Kazakhstan is far from a convincing long-term prospect, with no improvement in any political or structural risk indicators and deteriorating capital access, according to capital-market participants working in international bond and syndicated loan markets, and bank finance.

Lying 76th in Euromoney’s global risk rankings, Kazakhstan’s risk score continued to fall in the latest survey for Q1 2018, and is down more than 10 points overall since 2007, despite periodic improvements.

Higher oil prices will undoubtedly give the country another lift.

Capitalizing on this, the government is expanding energy-sector projects and ramping up hydrocarbons extraction, notably from the huge Kashagan oilfield in the Caspian Sea.

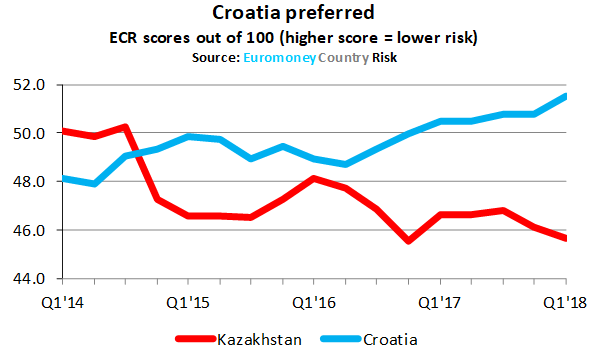

However, Kazakhstan’s deteriorating risk contrasts with safer prospects, such as Croatia, despite their differing credit ratings – unlike Kazakhstan, Croatia remains sub-investment grade:

Moreover, multilateral creditors are doubtful the economy will grow at the same pace this year.

In their most recent economic-outlook reports, both the Asian Development Bank and International Monetary Fund foresee GDP growth slowing to 3.2%, primarily due to a weaker industrial sector and lack of progress on the $9 billion diversification and modernization programme known as Nurly Zhol, devised as a crucial strategy for weaning the country off its oil and gas dependency.

And there are other concerns, one of which centres on the question of succession.

The elections in 2020 are possibly a time for Nursultan Nazarbayev, who will then be 80 years old, to hand over the baton, but also a potential flashpoint for instability regardless of whether he intends to serve another term.

Maintaining a tight grip on authority since independence, the president has managed to keep a lid on social unrest with repressive means, and mask other institutional flaws underlined by low scores for most political and structural risk indicators in Euromoney’s survey.

Writing in January, Paul Stronski, at the American Enterprise Institute, evaluated these and other themes, notably in relation to Islamist extremism and how Russia might respond.

Several of ECR’s expert contributors echo these views, mentioning in confidence a range of risks for investors, not least the lack of transparency, weak judicial protection and high levels of corruption.

Immediate concerns

Another pressing problem is to convince investors to absorb local currency debt to reduce the huge overhang of foreign liabilities vulnerable to the appreciation of the US dollar.

Official figures show the external debt burden rising by $74.6 billion since the global financial crisis in 2007-2008, to total $168.9 billion – an October 2017 figure, which will have undoubtedly increased.

The external debt burden, albeit slowly declining as a share of national income, exceeds 90% of GDP.

Underlined by a low bank stability score in Euromoney’s survey, the lack of local currency liquidity is also putting the banking system under strain, with struggling small lenders relying on the state for support.

One of those, Qazaq Banki, has had its licence suspended for three months; another, the Bank of Astana, suffered a run on deposits, forcing it to limit withdrawals, and rebuked by Nazarbayev for bad management.

One of the main problems is the lack of transparency making it hard to decipher the true level of non-performing loans.

A review of asset quality is due later this year.

Ultimately, it will provide a clearer picture, and with improved regulation and oversight, and measures to address balance-sheet frailties, it will strengthen the banking system in the longer term.

However, in the meantime, it could also unearth a more serious situation than that which is officially reported, and lead to a shared responsibility for losses among the creditors.

Euromoney Institutional Investor, Friday, May 25, 2018