Kazakhstan has been diverting crude oil exports away from the Baku-Tbilisi-Ceyhan pipeline to Russia's Caspian Pipeline Consortium route after contamination in Azerbaijan'sflagship Azeri Light crude disrupted the Mediterranean export system, according to S&P Global Commodities at Sea data Aug. 13 and an industry source with direct knowledge of the matter.

The contamination issue, first revealed by BP on July 24, has prompted force majeure declarations affecting shipments from Kazakhstan and Turkmenistan into the 1,800-km BTC pipeline. CAS data shows volumes crossing the Caspian from both countries have ground to a halt since late July, forcing Kazakhstan to rely more heavily on the 1.8 million b/d CPC pipeline through southern Russia.

The disruption has significantly impacted pricing for Azeri Light, assessed Aug. 13 by Platts at 45 cents/b above Dated Brent -- a dramatic decline from premiums exceeding $4/b before the contamination was discovered. The grade, normally sought-after for producing light oil products including diesel, gasoline and jet fuel, is expected to average loadings of just under 550,000 b/d in September, down from 586,000 b/d in the first half of 2025.

The temporary shift underscores the vulnerability of alternative export routes for Central Asian producers seeking to reduce dependence on Russian infrastructure.

Kazakhstan had been increasing shipments through BTC as part of efforts to diversify away from Russian export infrastructure, with officials forecasting 2025 volumes of about 1.7 million mt, or around 35,000 b/d. While relatively modest compared to total Kazakh exports, the BTC route represents a strategic alternative amid periodic disruptions to CPC operations and tensions linked to the Russia-Ukraine war.

The source of the Azeri crude contamination problem remains unclear, with BP saying it is working to resolve the problem alongside its partners in Azerbaijan and Turkey.

"While things are stabilizing in the Ceyhan terminal, BTC Co continues loading crude at Ceyhan with a program of sampling to assure quality," a BP spokesperson said Aug. 13.

The BTC pipeline company issued a notice of force majeure on July 29 to Azertrans, the Azeri operator of an oil terminal on Azerbaijan's coast at Sangachal that receives crude from across the Caspian. The notice has been seen by Platts, as has separate evidence of some individual cargoes at Ceyhan also being subject to force majeure. Testing of crude taken into the pipeline at Sangachal on July 22 had confirmed it to be within expected requirements, the notice to Azertrans said. Azertrans did not respond to requests for comment.

A BP spokesperson told Platts it did not comment on commercial and contractual matters relating to its exports.

Kazakh shipments across the Caspian to Baku normally originate at the giant Tengiz and Kashagan oil fields -- respectively, the country's highest and second-highest oil producers -- Kazakh sources said earlier.

The source with knowledge of the matter confirmed cargoes had been diverted away from the trans-Caspian route to the CPC pipeline across southern Russia on a short-term basis pending resolution of the issue, underlining the organic chlorides did not come from Kazakhstan.

A spokesperson for the operator of the Tengiz Field, Tengizchevroil, said it did not comment on specific details of its operations and commercial matters. State company KazMunaiGaz, which normally handles shipments from Kashagan across the Caspian, also did not comment.

CPC capacity

Kazakh President Kassym-Jomart Tokayev underscored his country's wish to increase crude shipments through BTC on a visit to Turkey on July 30. A CPC pumping station suffered a drone attack blamed on Ukrainian armed forces in February.

The temporary diversion of such oil into the Russian pipeline may not be seen as a problem for the time being, given the modest volumes involved – "a drop in the ocean," was how the industry source described the switch.

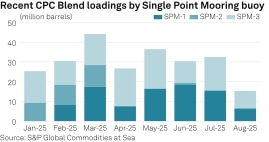

The CPC facilities are thought sufficient for Kazakhstan's needs thanks to ample capacity; however, one of the three offshore loading buoys -- known as single-point mooring buoys -- has remained out of action since an inspection by transport ministry regulators at the end of March 2025, CAS data shows. The CPC consortium has declined to specify when the suspended loading buoy would return to action, although the source in Kazakhstan said it remained available as a backup.

For Azerbaijan, the crude has continued to impact prices for the normally high-value Azeri Light grade. Italy's Eni has confirmed it received some of the contaminated crude into its system, while Orlen, operator of the Kralupy and Litvinov refineries in the Czech Republic, said it was holding some affected crude in storage. Austria's OMV has also reported detecting chloride contamination, without confirming whether it actually took the affected crude into its refineries.

Despite some loadings being subject to force majeure as the situation unfolded, other shipments have been going ahead. BP has said some crude storage facilities at Ceyhan have been verified as unaffected.

Azerbaijan's trademark Azeri Light grade is predominantly sourced from its own ACG oil complex in the Caspian, as well as including condensate from the Shah Deniz gas field. But the country has increasingly been adding crude to the mix from other producers such as Kazakhstan, aiming to support volumes as the ACG complex declines, while maintaining the distinctive quality of the crude.

Azerbaijan's state oil company Socar did not respond to requests for comment. Kazakhstan's energy ministry also did not respond to a request to comment.

Original article: S&P GLOBAL