This is part of an occasional series examining China’s efforts to win friends and clients in Asia and to assert a more dominant role across the continent.

This is part of an occasional series examining China’s efforts to win friends and clients in Asia and to assert a more dominant role across the continent.

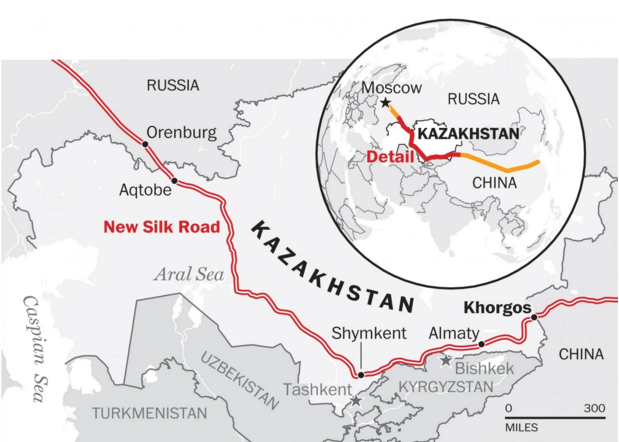

Slowly but surely, a four-lane highway is beginning to take shape on the sparsely populated Central Asian steppe. Soviet-era cars, trucks and aging long-distance buses weave past modern yellow bulldozers, cranes and towering construction drills, laboring under Chinese supervision to build a road that could one day stretch from eastern Asia to Western Europe.

This small stretch of blacktop, running past potato fields, bare dun-colored rolling hills and fields of grazing cattle, is a symbol of China’s march westward, an advance into Central Asia that is steadily wresting the region from Russia’s embrace.

Here the oil and gas pipelines, as well as the main roads and the railway lines, always pointed north to the heart of the old Soviet Union. Today, those links are beginning to point toward China.

“This used to be Russia’s back yard,” said Raffaello Pantucci, director of International Security Studies at the Royal United Services Institute in London, “but it is increasingly coming into China’s thrall.”

It is a shift that has shaken up the Russian leadership, which is watching China’s advance across the steppe with apprehension. Moscow and Beijing may speak the language of partnership these days, but Central Asia has emerged as a source of wariness and mistrust.

For China, the region offers rich natural resources, but Beijing’s grander commercial plans — to export its industrial overcapacity and find new markets for its goods — will struggle to find wings in these poor and sparsely populated lands.

In September 2013, Chinese President Xi Jinping chose Kazakhstan’s sparkling, modern new capital, Astana, to announce what has since become a cornerstone of his new, assertive foreign policy, a Silk Road Economic Belt that would revive ancient trading routes to bring new prosperity to a long-neglected but strategically important region at the heart of the Eurasian continent.

Bound together by 2,000 years of exchanges dating to the Western Han Dynasty and sharing a 1,100-mile border, the two nations, Xi said, now have a “golden opportunity” to develop their economies and deepen their friendship.

At the China-Kazakhstan border, at a place known as Horgos to the Chinese and Khorgos to the Kazakhs, a massive concrete immigration and customs building is being completed to mark that friendship, rising from the windswept valley floor like a mammoth Communist-style spaceship.

A short distance away, China is building an almost entirely new city, apartment block by apartment block, alongside a two-square-mile free-trade zone, where traders sit in new multi-story shopping malls hawking such items as iPhones and fur coats.

This is reputed to have been a 7th-century stop for Silk Road merchants. Today, the People’s Daily newspaper calls it “the pearl” on the Silk Road Economic Belt.

But this pearl is distinctly lopsided: On the Kazakh side of the zone, opposite all those gleaming malls, a single small building, in the shape of a nomad’s tent or yurt, sits on an expanse of wasteland where a trickle of people stop to buy biscuits, vodka and camel’s milk.

The Silk Road slogan may be new, but many of its goals are not. Beijing has long been working to secure a share of the region’s rich natural resources to fuel China’s industrial economy; it is building a network of security cooperation in Central Asia as a bulwark against Islamist extremism that could leak into China’s restive western province of Xinjiang, and it wants to create alternative trading routes to Europe that bypass Asia’s narrow, congested shipping lanes.

Under the Silk Road plan, China also is promising to spend hundreds of millions of dollars to build new infrastructure here, and it hopes to reap benefits of its own: to create new markets for Chinese goods, especially for heavy industries such as steel and cement that have suffered as the Chinese economy has slowed.

But the scene at Horgos underlines the fact that the economies of China’s Central Asian neighbors are simply too small to provide much of a stimulus to China’s giant financial system.

Russian opposition

China’s ambitious Central Asian plans did not go down well, at least initially, in Moscow.

“When China announced its Silk Road plan in Kazakhstan, it was met with a lot of skepticism and even fear by the Russian leadership,” said Alexander Gabuyev, head of the Russia in the Asia Pacific Program at the Carnegie Moscow Center. “The feeling was, ‘It’s a project to steal Central Asia from us; they want to exploit our economic difficulties to be really present in the region.’ ”

Russia had long blocked China’s attempts to create an infrastructure development bank under the auspices of the Shanghai Cooperation Organization, a regional body, fearing it would become a tool for Chinese economic expansion. Beijing responded by sidestepping Moscow, establishing an Asian Infrastructure Investment Bank in June with a $100 billion capital base.

China has overtaken Russia to become Central Asia’s biggest trade partner and lender. Pipelines transport increasing amounts of Kazakh oil to China and vast quantities of Turkmen gas east through Horgos. That has served to undermine Russia’s negotiating position when it has tried to sell its own gas to China.

At the same time, however, Xi has worked overtime to calm Russian fears, reassuring his counterpart Vladimir Putin that Beijing has no plans to counter his country’s political and security dominance in Central Asia.

In 2014, Russia attempted to draw the region more closely into its embrace by establishing a Eurasian Economic Union, with Kazakhstan a founding member. But even as Moscow moved to protect its turf, the realization was dawning that Russia lacked the financial resources to provide Central Asia the economic support it needed.

After the breakdown of relations with the West over Ukraine in 2014, and the imposition of sanctions, the dogmatic view that Russia had to be the top economic dog in Central Asia was questioned and then finally, grudgingly abandoned.

It was impossible, Gabuyev said, so Russia’s leaders decided to divide the labor: Russia would provide security, while China would bring its financial muscle.

In May, Xi and Putin signed a treaty designed to balance the two nations’ interests in Central Asia and integrate the Eurasian Economic Union and the Silk Road.

China’s expanding influence has provoked mixed feelings in many Asian states, and it has used “velvet gloves” in its dealings with Central Asia, said Nargis Kassenova, an international relations expert at KIMEP University in Almaty.

About a quarter of Kazakhstan’s citizens are ethnic Russians, while Russian media dominate the airwaves. The Chinese language, by contrast, is nowhere to be seen or heard. Even India has more cultural resonance through Bollywood films, says political scientist Dossym Satpayev in Almaty.

What Beijing can offer is infrastructure loans and investment. It has been careful to frame its plans as more than just a “road” — where Kazakhstan’s natural resources are extracted, and Chinese goods waved through on their way to Europe — but as a “belt” of economic prosperity.

Nevertheless, a survey conducted by independent analyst Elena Sadovskaya found that Kazakh attitudes toward Chinese migrant workers reflect fears that China would one day dominate the country, swamp it with immigrants and cheap goods, grab land or simply suck out its natural resources while giving little in return. “In 2030, we’ll all wake up and find ourselves speaking Chinese,” is one common saying here.

In July, scores of people were injured when a mass brawl broke out between Chinese and local workers at a copper mine near the northern Kazakh city of Aktogay.

Kazakhstan’s foreign minister, Erlan Idrissov, plays down concerns. China may outnumber the 17 million Kazakh population by 80 to 1, but its progress and development represent good news, he says.

“Our philosophy is simple: We should get on board that train,” he said in an interview in Astana. “We want to benefit from the growth of China, and we don’t see any risks to us in that growth.”

China’s state-owned investment giant CITIC runs an oil field and an asphalt factory in Kazakhstan and says it has established a $110 billion fund to invest in Silk Road projects, much of the money aimed at Kazakhstan and Central Asia.

Kazakh traders wait for their goods purchased from China to be cleared on the Kazakh side of the Horgos free-trade zone near Horgos, Kazakhstan, on Sept. 14. (Adam Dean/For The Washington Post)

But private Chinese companies and ordinary Chinese traders say they have yet to reap the rewards, as the small Kazakh economy is shrinking under the weight of falling commodity prices and Russia’s economic decline.

Meanwhile, Russia is playing interference, they say, imposing new import restrictions under the Eurasian Economic Union in an apparent attempt to keep Chinese goods from flooding the region.

In Almaty, the Yema Group has been importing Chinese bulldozers, diggers and other heavy equipment for more than a decade. Business, once booming, has collapsed in the past two years, as many Chinese vehicles fail to meet tough Russian certification standards that now apply throughout the economic union.

Shi Hairu, a 52-year-old trader from Shanghai who sells Chinese gloves in a small shop in a market in Almaty, arrived two years ago when the economy at home started to slow. But sales have been halved this year — a sharp depreciation in the Kazakh currency, the tenge, has drastically reduced locals’ purchasing power, while customs clearance has become slower and costlier.

In the Horgos free-trade zone, Chinese traders also say business is poor. Many were lured here by tax breaks, cut-price deals to rent shops and enthusiastic cheerleading by state media about the opportunities on offer.

“After we came here, we realized it was all lies,” said one owner of a shop that sells women’s underwear who declined to be named for fear of trouble with the authorities.“We basically got deceived into coming here.”

The Kazakh government is building a “dry port” at Khorgos — with warehouses, an industrial park and rows of cranes to transfer containers across different railroad gauges — in what it hopes will become a major distribution and transshipment hub for goods bound between China and Western Europe, a “mini-Dubai” in the making. But the nearby free-trade zone still boasts just the one small supermarket, guarded by four lonely concrete camels, plastic flowers in their saddlebags. The nearest Kazakh city, Almaty, is a five-hour drive away along a bone-jarring road.

Yang Shu, director of the Institute of Central Asian Studies at Lanzhou University, calls Horgos “a mistake” because so few people are in its vicinity. Trade between the two nations declined 40 percent in the first six months of this year, to $5.4 billion, just a quarter of 1 percent of China’s global trade.

Nevertheless, experts agree that China’s Silk Road plan has immeasurably more clout than the American New Silk Road plan advanced by then-Secretary of State Hillary Clinton in 2011 that was meant to bind Afghanistan to Central Asia but that barely got off the ground, or Russia’s own pivot to Asia, mired in economic woes and bureaucratic inertia.

For now, Pantucci, at the Royal United Services Institute, said China and Russia have established some sort of “modus vivendi” here. “I used to believe Central Asia would become a bone of contention between the two countries, but the priority in Moscow and Beijing remains the broader strategic relationship,” he said. “Wrinkles like disagreements in Central Asia will get swept underfoot.”

But Tom Miller, at a consulting firm called Gavekal Dragonomics, argues that as Beijing’s investment and financial ties with Central Asia deepen, “its political influence will inevitably strengthen,” too. Harking back to the “Great Game,” the 19th-century contest between the British and Russian empires’ influence in Central Asia, he says there is only one winner this time around.

“Beijing’s strategists studiously avoid any talk of playing a ‘New Great Game’ in the heart of Asia — but they look set to win it nonetheless,” Miller said.

Gu Jinglu and Adam Dean contributed to this report.

This is part of an occasional series examining China’s efforts to win friends and clients in Asia and to assert a more dominant role across the continent.

December 27, 2015, The Washington Post