Six months ago this week, the Eurasian Natural Resources Company slunk away from the London Stock Exchange. Rarely has a City star so quickly dimmed. Its exit was the culmination of a series of scandals that involved allegations of destruction of sensitive documents, corruption in Africa, boardroom leaks in London, backbiting between auditors, investigators and directors in the City and the humiliation of UK regulators.

Six months ago this week, the Eurasian Natural Resources Company slunk away from the London Stock Exchange. Rarely has a City star so quickly dimmed. Its exit was the culmination of a series of scandals that involved allegations of destruction of sensitive documents, corruption in Africa, boardroom leaks in London, backbiting between auditors, investigators and directors in the City and the humiliation of UK regulators.

Top City names such as the former head of the Government's UK Financial Investments body Sir David Cooksey; Sir Paul Judge, who is now being sued by the company amid allegations, which he denies, of leaking documents; the City banker Mehmet Dalman; GlaxoSmithKline's former chairman Sir Richard Sykes, and Ken Olisa, the owner of the boutique merchant bank Restoration Partners, have all come away damaged.

The Serious Fraud Office is now going through the entrails of ENRC although sources close to its former director Richard Alderman, who first had contact with the company, are pessimistic, saying the police will struggle to bring charges over corruption claims.

Others close to the investigation have suggested ENRC was less than careful about preserving key evidence – an allegation ENRC denies. UK shareholders lost big time financially from ENRC. They bought in at 540p a share in an IPO that raised £1.4bn for the company, valuing it at £13bn. Five and a half years later, in August 2013, the entire business was valued at £3bn and the shares had slumped from peaks of £11 to just 220p.

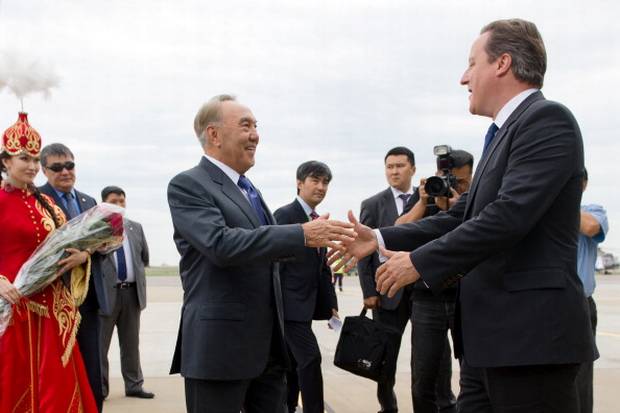

In Kazakhstan, Nursultan Nazarbayev, the 73-year-old autocratic president, now faces a dilemma over dealing with the wounded company and his long-time friend Alexander Maskievitch. ENRC is a national champion, one of country's biggest companies in the aluminium industry, and a major contributor to Kazakh GDP. But its antics in London have become a Borat-like embarrassment. Mr Maskievitch, an early supporter of Mr Nazarbayev, obtained a 20 per cent stake in the business in early 1990s. He was supported by a diplomat from Uzbekistan, Patokh Chodiev, and a tough businessman from Kyrgystan, Alijan Ibragimov. They each hold a 20 per cent stake andcontinue to run the private business, known as Eurasian Resources Group, out of Luxembourg.

Kazakh government involvement in the UK machinations has led some observers in the central Asian state to speculate that the Nazarbayev family have equity interests in the company. One analyst said: "I would not be surprised if he or his family is shown to have control of the business when he dies."

A reshuffle of the shareholdings in ENRC is now a possibility, with Mr Maskievitch possibly being a loser. One source said: "[Mr] Nazarbayev will always be the diplomat as he will not wish to hurt his friend. But [Mr] Maskievitch's position is a lot less secure than it was." Others speculate he has been relegated from the President's magic circle of supporters.

ENRC's future is also in doubt. Almaty is rife with talk that Glencore has put its slide rule over the assets and may be about to bid for all or some. Former Kazakh prime minister Oraz Jandosov says: "Glencore have been over here. They are valuing the assets. They are talking to the relevant parties."

A London firm of investigators is also thought to have been hired to carry out due diligence on a number of African assets belonging to ENRC. The President is thought to be undecided about handing over a strategic interest to an external concern. Sources close to the company confirmed that the owners are seeking to dispose of its valuable assets.

Speculation is rife of a potential sale of its mining properties in the Democratic Republic of Congo, bought between September 2009 and July 2011 using the controversial Israeli investor Dan Gertler. He bought the storied Kolwezi copper installations from the DRC government in 2009 and "flipped" them to ENRC. British-based board members, in particular Sir Paul, expressed City doubts about the deals to fellow board members and voted against it, but were slapped down.

The use of myriad offshore companies in the African deals, as well as the contractual arrangements with previous owners, Canada's First Quantum, were investigated by the anti-corruption NGO Global Witness. More damaging was litigation from First Quantum, which challenged the deal in court, winning a $1.25bn (£744bn) settlement.

When whistleblowers sent allegations of corruption in Kazakhstan, the board had them thoroughly investigated. But the investigation, by Neil Gerrard, a corporate lawyer at DLA Piper (who later moved to rival law firm Dechert) "got out of hand" says one investigator. "The cost and time far outweighed the seriousness of the allegation," he says. When the law firm was sacked in April 2013, a letter from the firm to the board was leaked.

The letter referred to the company's claim that the law firm had "negligently and improperly handled many significant aspects of the sensitive engagements". But, in the leaked reply, Mr Gerrard wrote, "there is no basis for this false allegation". Mr Gerrard claims that the firm's investigators were provided with false documents and saw evidence of document destruction. Meanwhile, K2, the investigative firm, was hired to pursue the leaks.

ENRC has always said it is committed to a full and transparent investigation of its procedures and conduct, and is co-operating fully with the SFO.

The company insists it is retaining its physical presence in the UK and has no intention of leaving. But sources told The Independent that moves are afoot for ENRC's total disappearance from London by the end of the year. For the many whose reputations have been irreparably damaged by its arrival, that time cannot come soon enough.

Tomorrow: Nick Kochan reports on Almaty's dangerous mixture of politics and business

www.independent.co.uk