Developed by Western Oil Companies, Giant Project Off Kazakhstan Is Years Late, More Than $30 Billion Over Budget. Kazakh workers were recuperating from the frigid temperatures of the Caspian Sea over cups of tea when their Italian supervisor interrupted their break, demanding they return to work. The workers restrained the supervisor— a manager working for Eni ENI.MI +0.17% SpA, a company building a giant oil development here—and put a plastic bag over his head. He fled, packed his bags and left Kazakhstan.

Developed by Western Oil Companies, Giant Project Off Kazakhstan Is Years Late, More Than $30 Billion Over Budget. Kazakh workers were recuperating from the frigid temperatures of the Caspian Sea over cups of tea when their Italian supervisor interrupted their break, demanding they return to work. The workers restrained the supervisor— a manager working for Eni ENI.MI +0.17% SpA, a company building a giant oil development here—and put a plastic bag over his head. He fled, packed his bags and left Kazakhstan.

The spat was a brief episode yet emblematic of the endless challenges that have hobbled a project once hailed as the dawn of a new era in cooperation between oil-rich countries and Western companies.

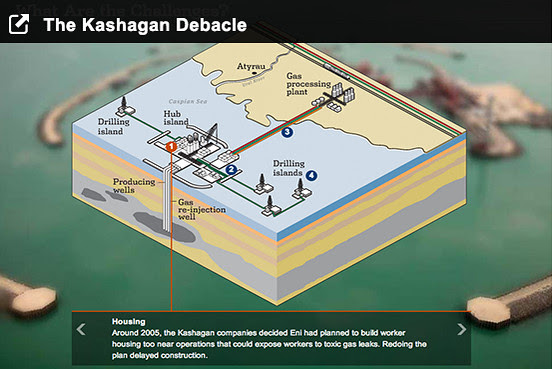

(Interactive graphic: How four energy giants, 10 man-made islands and nearly $50 billion add up to zero barrels of current oil production.)

Asked about the 2011 incident, which was described by Western oil-company managers, a senior Eni executive said that he wasn't familiar with it but that friction between workers and management is a periodic occurrence.

Tantalizing rewards were envisioned for both sides from the oil project here, known as Kashagan, at the outset two decades ago. Royal Dutch Shell RDSB.LN +0.04% PLC and other international companies would deploy their expertise and reap profits; Kazakh President Nursultan Nazarbayev would pry open the doors of a former Soviet republic to modernize the economy of a nation of steppes. Oil would flow in 2005 and eventually reach 1.5 million barrels a day, roughly equal to the U.K.'s daily use.

Instead, the project has been plagued by budget blowouts, engineering missteps and management disputes extending from offshore roughnecks to top government and corporate leaders. Miles of leaky pipeline make up what is arguably the world's most expensive plumbing problem. The project is years late, more than $30 billion over budget and now halted indefinitely.

Both sides are straining to understand what went wrong. They complain about an unwieldy management structure. Western oil executives say the Kazakh government has held up decisions and imposed onerous requirements for employing local workers. The Kazakhs say the companies made mistakes that included underestimating the challenge of corrosive gas, making plans that needed frequent revision and not doing the welding right.

Eni Chief Executive Paolo Scaroni said his company's relationship with the government "has been excellent" considering the years of trouble. A senior official of Kazakhstan's state-owned KazMunaiGas, or KMG, disagreed. "It's a marriage that is made in hell," he said.

The Kashagan project's travails—reconstructed from interviews with some 40 people involved in it—come at a time when relationships between Western oil companies and resource-owning governments are more important than ever. To replace what they pump, oil companies need to collaborate with state-owned companies that control 90% of the globe's remaining oil reserves, by a World Bank estimate. But governments often give foreign oil companies access only to the hardest-to-develop acreage. Kashagan's large-scale stumble shows how collaborations in these difficult fields can go sour for both sides.

Within Kazakhstan, an earlier and smaller oil project has fared better. Tengiz, about 80 miles east of Kashagan, has helped the country raise its oil production through the years to over 1.6 million barrels a day. But Tengiz didn't have several rival oil companies with equal shares jousting for position— Chevron Corp. CVX 0.00% is the dominant partner—and it is on land, not offshore.

As much as Kashagan's costs have risen, they don't necessarily mean the project can't someday be profitable, given that oil prices have also climbed sharply since it began. The costs of $50 billion or so—about $42 billion for development plus $8 billion spent toward the second, production phase—have been paid by all of the oil companies involved, including state-owned KMG. The deal gives most production to the oil companies until their development costs are recovered.

Kashagan's challenges stem partly from its environment. The project lies in shallow water that freezes all the way to the sea floor in winter, making drilling with conventional rigs impossible. The companies had to build artificial islands of rock and rubble and drill through these.

Kashagan is one of the world's most ambitious oil developments and the biggest new field in decades. But despite $50 billion in investment by some of the world's largest oil companies and the Kazakhstan government, the Caspian Sea-based project isn't working.

The oil far below is under high pressure from natural gas high in toxic, corrosive hydrogen sulfide. That meant building a sulfur-removal system onshore, reached by a pipeline, for the portion of the gas to be recovered. Heavy pipe-laying machines sometimes broke down in the cold.

The companies clearly misgauged the time and cost of surmounting such obstacles. Kazakhstan has responded by levying financial penalties, in one case by increasing its ownership stake.

The Kashagan story dates to 1989, when Mr. Nazarbayev, then Communist boss of the Kazakh Soviet Socialist Republic, traveled to Colorado to study cattle ranching. There, he met Jack Grynberg, a Polish-born Holocaust survivor and self-made oil man, who showed the Kazakh leader his oil wells. The following year, Mr. Grynberg said, he took Mr. Nazarbayev to Venezuela's Lake Maracaibo oil fields, where shallow waters are reminiscent of the northern Caspian.

"He was inspired by what he saw," Mr. Grynberg said. "He said he wanted Kazakhstan to be bigger than Venezuela." Mr. Nazarbayev declined to be interviewed. Mr. Grynberg has since claimed he should have a percentage of Kashagan, in lawsuits against oil companies, one of which resulted in a settlement.

After the 1991 Soviet collapse, Western oil companies sought exploration permits. Kazakhstan didn't want to involve the companies, according to people involved with the project's early stages. But it needed their skills, said Daniyar Berlibayev, deputy chairman of the state oil company, KMG.

Foreign companies began seismic tests in 1993, and in 1997 Kazakhstan struck a 44-year deal with firms including Eni, Shell, Total SA and predecessor companies ofConocoPhillips COP 0.00% and Exxon Mobil Corp. XOM -0.02% Shell drillers in 2000 confirmed the field was an "elephant," one of the biggest oil discoveries in decades.

That set off a competition to be lead operator. A tentative deal put Exxon in the lead, and its employees soon had cards calling Exxon "operator designate." But Shell's chairman, Phil Watts, told another Shell official he didn't want his biggest rival in control, according to the other official. The deal disintegrated.

Mr. Watts, now a parish priest in rural England, declined to comment. "This is a long time in history for me," he said.

The companies agreed in 2001 that instead of Exxon, the far smaller Eni would lead development. Each company, including KMG, got veto power over major planning decisions.

Eni estimated it would cost $10 billion to develop Kashagan, and oil production would begin in 2005.

By 2003, Mr. Nazarbayev was airing frustration with the pace. "We will demand that the investor meets his contractual obligations," he said that year. By the time companies made final plans to move ahead with Kashagan in 2004, they had been assessed millions of dollars in penalties for delays.

Their deal required them to hire Kazakhs for many tasks, including some desk jobs. One former official recalled hiring hundreds of enthusiastic locals who had "never sat in front of a computer."

For other jobs, the companies imported experienced workers. Floating barracks, made of old Soviet cruise ships, were a modern-day Babel, with laborers speaking Kazakh, supervisors speaking Italian and welders speaking Turkish, Chinese and other tongues.

Underground, the situation was complex. In exploration wells drilled to 13,000 feet, gas associated with the oil proved to be more than 17% hydrogen sulfide, said officials from two companies. It took operators nearly two years to factor this level of sour gas into infrastructure design, as engineers made errors and argued over specifications, a senior engineer said.

Besides construction-worker barracks, offshore accommodations for the permanent staff were needed. Around 2005, Eni's partners realized that plans for these put them too near a production site. Eni redesigned the accommodations, delaying construction by a year. The Eni spokesman said the housing was redesigned at the same time as other facilities to increase Kashagan's production capacity. Eni also has blamed engineering challenges for the rising costs.

Meanwhile, Kazakh officials were complaining that KMG people had no roles in upper management of the project, said a KMG executive.

In 2008, the Kazakhs and foreign executives struck a deal pushing the date of the first oil production far out to 2013—and levying more penalties for delay.

Last year, longtime partner ConocoPhillips sold its stake in the project to KMG, which later resold it to China National Petroleum Corp. "We got our $5.5 billion in the bank and got out of Kashagan," said Al Hirshberg, a Conoco executive, at a conference last fall.

He added: "It feels good to be out of it."

Last summer, the companies prepared for a milestone: starting commercial oil production and transferring the role of operator to a Shell-led group. Workers walked the aboveground part of the gas system to inspect valves and compressors, attaching colored stickers to equipment to show each company had signed off. On Sept. 11, the companies announced that oil was flowing. Bond-rating firms predicted an economic boost for Kazakhstan.

About two weeks after that, security guards on routine patrol noticed a haze on the horizon along the path of the underground part of the gas pipeline. Oil pumping stopped while workers in masks inspected and found a leak. Crews patched it, and oil pumping resumed.

Two weeks later, the pipeline sprang new leaks. This time, the companies shut down the whole Kashagan operation.

"After the first leak we replaced one or two pieces, and I thought, 'That's it, thank God,' " Kazakh Oil Minister Uzakbay Karabalin said in his Astana office, as snow blew outside. "Then it happened again, and my blood pressure really jumped up."

Workers spent the fall excavating parts of the 55-mile pipeline and sending sections for tests at a U.K. lab. Oil company and Kazakh officials sniped at one another. "Nobody's happy with the governance, and I don't think anybody's happy with the operatorship," Shell Chief Financial Officer Simon Henry said.

Cracks were found in several places along the pipeline, according to people familiar with the inspection, who said it appeared the metal had lost some of its factory characteristics, possibly through a combination of poor welding practices and the natural gas's hydrogen-sulfide content.

Eni's Mr. Scaroni flew to Astana in November for a sober meeting with the CEO of KMG, Sauat Mynbayev, but was unable to say for sure why the pipeline failed and when it might be fixed, said a person briefed on the meeting. The companies promised an answer in January. Messrs. Scaroni and Mynbayev declined to discuss the meeting.

There were still no explanations by late January, when Mr. Nazarbayev, attending the World Economic Forum in Davos, Switzerland, stepped away to talk with Christophe de Margerie, CEO of France's Total.

The two had warm ties going back to the Frenchman's work at Kashagan before becoming Total's chief. They looked dour settling into armchairs in a wood-paneled conference room. Mr. Nazarbayev, after flashing a smile for a photographer, sat stiffly and pressed for assurances output would soon restart. He nodded and fidgeted as Mr. de Margerie said he still didn't know the reason for the leaks or when oil would flow. The companies have promised a report on the leak soon.

In recent meetings, companies suggested forcing all gas back into the reservoir, which would allow oil production even if they couldn't fix the pipeline. Some leaders of KMG were skeptical, said an official there, worried this could lower the field's production after Western companies' contract expires in 2041.

This month, Kazakhstan's environment ministry said it would fine the Kashagan companies about $735 million for burning gas emptied from the pipeline after the leak. A spokesman for the Kashagan consortium, which represents the companies, said it would appeal the fines.

While the sides negotiate fixes and penalties, Mr. Karabalin, the oil minister, said he is struck that companies brought in for their engineering prowess were thwarted by a plumbing failure. "It's annoying that the simplest piece of equipment in the project is the one that failed," he said.

"The more complex equipment is all working fine," he added, as he knocked on the wooden table and spat over his left shoulder, in a regional gesture to ward off bad luck.

—Daniel Gilbert and Liam Moloney contributed to this article.

Write to Selina Williams at

and Justin Scheck

The Wall Street Journal