On London's Billionaires Row in Hampstead, the seven-bedroom Carlton House with its 50-foot ballroom, underground swimming pool and 10-person Turkish bath is for sale for 14 million pounds ($21.5 million).

On London's Billionaires Row in Hampstead, the seven-bedroom Carlton House with its 50-foot ballroom, underground swimming pool and 10-person Turkish bath is for sale for 14 million pounds ($21.5 million).

It's being sold to repay BTA Bank after British courts seized assets from the Kazakh lender's one-time chairman, billionaire Mukhtar Ablyazov. The lender accused him of embezzling about $6 billion from the bank, claims he says are false and politically motivated.

It took the U.K. High Court to establish that the home, with its marble bathrooms, crystal chandeliers and cherry-wood elevator, belongs to the 51-year-old, because the property was bought through a network of offshore companies that hid his identity. He argued it was his brother-in-law's and he just rented it after his family moved to England in 2009.

Buying upscale homes in the U.K. through trust funds and overseas-based companies is popular among the rich as a way to minimize taxes and protect privacy. The practice also makes it difficult for law enforcement and the courts to establish whether their owners bought them legitimately. Hundreds of billions of pounds classified as the proceeds of crime are laundered here every year and London's surging property market is one of the more attractive ways to do it, according to the U.K. National Crime Agency.

Real estate's role in laundering money is "not one we understand well enough by any stretch of the imagination," said Donald Toon, director of the NCA's economic crime unit. "We're not saying that money laundering is endemic in the property market, but we are saying it looks like there's a problem here."

Luxury Tax

A new tax on luxury homes owned by corporations yielded 100 million pounds last year, almost five times more than expected, according to Her Majesty's Revenue and Customs. As part of the levy, companies have to pay as much as 143,750 pounds a year to keep their owners' names private if they own residential property worth more than 1 million pounds and don't lease it.

Eighty percent of the tax revenue came from owners in Westminster and Kensington & Chelsea, London's most expensive boroughs for housing. More than a quarter of the homes sold for more than 1 million pounds in prime central London in the year through June 2013 were bought by people who aren't based in the U.K., according to Knight Frank LLP, a real estate broker.

The surprise windfall for HMRC prompted the NCA to start examining whether some of the houses were bought to launder money. The figures highlight both how attractive U.K. real estate is for wealthy investors globally, and why it's vulnerable to crime.

Good Investment

"A money launderer or somebody with significant illicit assets is attracted to a good investment in the same way as somebody who has legitimate assets is attracted to a good investment," Toon said in an interview last month.

The U.K. government plans to publish its first national risk assessment of money laundering and terrorist financing this month, according to a Treasury spokesman. The report, which will include real estate, will look at the role of estate agents in fighting money laundering. Legislation is also being drawn up requiring the ultimate owner of U.K. companies to be listed on a registry.

The government should go even further and require all property-owning companies to disclose who really owns them, said Nick Maxwell, head of research at Transparency International. The advocacy group will publish a report on how British real estate is used by money launderers this week.

Secrecy Preference

The amount raised from the levy on luxury homes shows there's a "big preference for secrecy," he said. "It's part of the problem of offshore ownership in the U.K.

Buyers of luxury real estate often purchase the holding company rather than the property directly to avoid paying stamp duty, a tax owed when a sale goes through. This means the name of the owner on paper doesn't change, while the real proprietor does, according to the Serious Fraud Office's proceeds of crime unit.

Former BTA Bank chairman Mukhtar Ablyazov arrives under police protection at the courthouse in Lyon, France, on Oct. 17, 2014. He's now in jail near Paris, awaiting a verdict on his appeal against extradition to face criminal charges in Russia or the Ukraine in the embezzlement case.

A 10 million-pound townhouse in Hampstead belonging to the late dictator Muammar Qaddafi's son, al-Saadi Qaddafi, was purchased with Libyan state funds diverted through a British Virgin Islands-based company called Capitana Seas. In 2012, a U.K. judge ruled it was "wrongfully and unlawfully purchased" and awarded to the Libyan state.

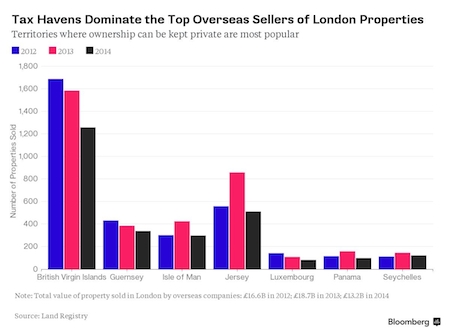

More than 12,500 London properties worth over 48.5 billion pounds were sold by offshore companies from 2012 through 2014, Land Registry data compiled for Bloomberg News show. The registry only has information on sales, not purchases.

More than a third of the sellers were out of the British Virgin Islands, where Mount Properties Ltd., which bought Carlton House, is based. Mount Properties is owned by Mega Property Ltd., a company based in the Marshall Islands, according to the High Court ruling on seizing Ablyazov's assets including the home. Neither jurisdiction requires disclosure of beneficial owners of companies.

Marble Hallway

The home on The Bishops Avenue, one of two London streets known as Billionaires Row because of the large number of wealthy residents, has a manned security hut and security cameras out front. Inside, a marble hallway with a wrought-iron staircase welcomes visitors, according to broker Glentree Estates, which is acting on behalf of receiver KPMG LLP.

The High Court found Ablyazov in contempt for lying about owning the home and other assets. After he didn't show up for his sentencing hearing -- he got 22 months in prison -- it was discovered that he'd fled the U.K. He's now in jail in France, awaiting a verdict on his appeal against extradition to face criminal charges in Russia or the Ukraine in the embezzlement case. BTA, once Kazakhstan's biggest bank, was bought last year by Kazkommertsbank and a local businessman after defaulting twice.

Fraud Victim

Ablyazov "is the victim of a massive fraud committed against him by a dictatorial regime," according to a statement from his lawyer, Peter Sahlas.

One of the biggest obstacles in tracing proceeds of crime is that law enforcement receive few reports of suspicious customer activities that are related to real estate, and those they get aren't always useful, according to Transparency International. Just 179 of the 354,186 reports filed in the year ending in September came from property brokers.

"For an individual estate agency, regular business with any high-net-worth individual can be very lucrative for the company and, therefore, there can be a lack of incentive to report of suspicions," Maxwell said. "A similar risk arises in small practices in the legal and accountancy sector."

Her Majesty's Revenue and Customs, which regulates property brokers, has started making unannounced supervisory visits to property brokers to ensure they are carrying out proper due diligence including identifying the true owners, the tax agency said by e-mail.

The legal sector also need to improve its suspicious customer filings, Toon said. Some of the reports don't identify "the criminal property involved, who's doing the transaction and what is the reason for suspicion," he said.

'Back-Covering Exercise'

A big part of the problem is that the filings aren't driven by a desire to genuinely police against money laundering, according to Dick Gould, joint deputy head of the proceeds of crime unit at the SFO.

Suspicious activity reports "are supposed to identify what is being laundered, and at the moment you get a lot of institutions, predominantly banks but not only banks, using it as a back-covering exercise," Gould said.

Gould also said that while anonymity around property ownership draws suspicion, there are many high-net-worth individuals who own houses through trust funds and corporate structures for legitimate reasons. That can make it harder for law enforcement and the property industry to police.

"It's really important we have effective collaboration and exchange of information between national financial intelligence units," Toon said. "If we are seen to be a major money- laundering problem, then that undermines confidence in the U.K. as a place to do business."

March 2, 2015