Central Asian countries (CACs), consisting of Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan and Uzbekistan, are not yet key export markets or investment destinations for Hong Kong companies, but they are playing an increasingly pivotal role in the China-Central Asia-West Asia Economic Corridor. This is very much integral to the Silk Road Economic Belt (SREB), which is aimed at deepening and expanding mutually beneficial cooperation in such areas as trade, investment, finance, transport and communication. The national development strategies of the five CACs all share common ground with the SREB or the land-based component of the Belt and Road Initiative (BRI) being driven by China. As a "super-connector", Hong Kong is ready to deliver game-changing solutions for the 60-plus countries along the Belt and Road, including China's immediate neighbours in Central Asia.

Central Asian countries (CACs), consisting of Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan and Uzbekistan, are not yet key export markets or investment destinations for Hong Kong companies, but they are playing an increasingly pivotal role in the China-Central Asia-West Asia Economic Corridor. This is very much integral to the Silk Road Economic Belt (SREB), which is aimed at deepening and expanding mutually beneficial cooperation in such areas as trade, investment, finance, transport and communication. The national development strategies of the five CACs all share common ground with the SREB or the land-based component of the Belt and Road Initiative (BRI) being driven by China. As a "super-connector", Hong Kong is ready to deliver game-changing solutions for the 60-plus countries along the Belt and Road, including China's immediate neighbours in Central Asia.

Best known for its trans-Asian commerce, via the ancient Silk Road, harsh geography (a lack of ocean access, an arid or steppe climate and mountainous landscapes) and sparse population are common images of Central Asia. Thanks largely to the region's vast amounts of natural resources, which were underexploited during the Soviet era, the past decade's high commodity prices have boosted the performance of the Central Asian economy. Combined, the five CACs – namely Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan and Uzbekistan – make Central Asia a US$339-billion, 68 million-strong economy, with varying levels of development and purchasing power.

Benefiting from abundant mineral resources such as petroleum, natural gas, antimony, aluminium, gold, silver, coal and uranium, the energy sector has a key role to play in the economic development of the five CACs. Aside from having rich mineral deposits, the agricultural economy is also an important economic driver, with cotton, meat, tobacco, wool and grapes being major agricultural exports.

Given the abundance of rich and varied resources, economic growth in the five CACs has recently been curbed by nosediving oil and commodity prices. This, together with the spillover from sanctions applied by the West (the EU, the US, Canada, Australia and Norway) on Russia, continues to exert pressure on the overall GDP growth of Central Asia. Against this backdrop, the average growth in the five CACs is therefore estimated to slide from 6.6% in 2014 to 4.4% in 2015, before climbing back up to a brighter 5.3% in 2016.

Intra-regional trade in Central Asia has not been as significant as in Southeast Asia. For instance, in 2014, it only accounted for 7% of the total trade in Central Asia[1]. The relatively low dependency on regional trade, however, indicates a higher readiness to trade with partners further afield, including the CACs’ nearest neighbours, such as Russia and China. Moreover, the need for a more diversified economy, particularly in terms of manufacturing development, also indicates investment opportunities for Chinese companies.

While Central Asia is becoming an increasingly dynamic region connecting Eastern Europe and West Asia under the BRI, it can also be a challenging region for many new-to-the-market traders and investors. For instance, out of the five CACs, only Kyrgyzstan (since 20 December 1999) and Tajikistan (since 2 March 2013) are currently WTO members. Kazakhstan, whose accession is expected in early 2016, and Uzbekistan, are only observer states, while Turkmenistan has not even presented its candidature to the WTO.

Against this backdrop, customs clearance in Central Asia is often said to be overburdened, with bureaucratic obstacles leading to significant delays. Problems such as arbitrary seizures of goods, frequent changes in customs procedures without prior notification, excessive documentation and a lack of proper protocols to ensure that an appropriate appeals process is in place can make the importing process very uncertain, costly and time-consuming.

To a similar extent across all five CACs, business and cultural ties with Russia penetrate almost every area of daily and business life in the region. Not only do most people communicate with each other in Russian, they are also deeply accustomed to Russian culture, including movies and music. Russia also remains the most influential trading partner for most of the CACs, buying large amount of raw materials from and exporting a great deal of consumer and capital goods to all five countries.

The Customs Union, which became the Eurasian Economic Union (EAEU) from January 2015 and involves currently Kazakhstan, Russia, Belarus, Armenia and Kyrgyzstan, has further strengthened Russia’s influence in Central Asia’s trade development. While this has its advantages, it can also cast clouds, however. The recent recession in Russia and the sharp depreciation of the ruble have taken a toll on the Central Asian economy, imperiling the financial lifeblood of many Central Asian households and businesses.

Central Asia Under the Belt and Road Initiative

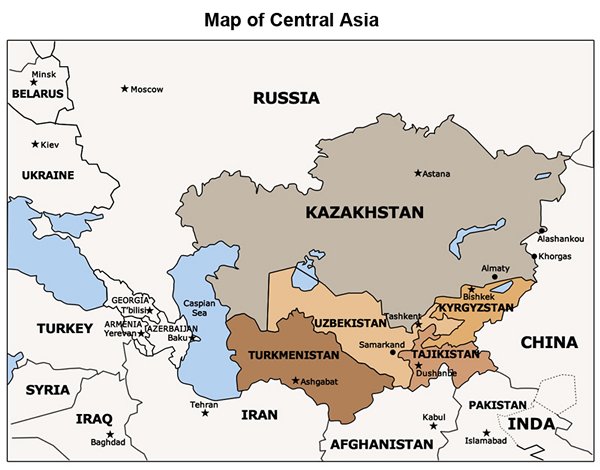

Central Asia has been crucial to the BRI ever since the Initiative was first suggested by President Xi Jinping in Kazakhstan in September 2013. In particular, the China-Central Asia-West Asia Economic Corridor, one of six economic corridors spanning Asia, Europe and Africa, runs from Xinjiang in China, then exits the country via Alashankou, joining the railway networks of Central Asia and West Asia before extending to the Persian Gulf, the Mediterranean coast and the Arabian Peninsula. The corridor covers all five CACs, as well as Iran and Turkey in West Asia.

Picture: The BRI: Six Economic Corridors Spanning Asia, Europe and Africa

In conjunction with the BRI developments, the SinoKazakh Cooperation Centre is located right on the border between China and Kazakhstan, in Khorgas. China's youngest city, Khorgas was officially established on 26 June 2014, and attracted nearly two million traders, from both sides, in that year alone. China is also extending its wings to encompass many of the region’s infrastructure and logistics projects, including various oil and gas pipelines, dry ports and railway tunnels – including a 19-kilometre railway tunnel under the Kamchik Pass in double-landlocked Uzbekistan linking the country’s populous Ferghana Valley with other major cities such as the capital, Tashkent.

China has also signed bilateral agreements on the building of the SREB with Kazakhstan, Kyrgyzstan, Tajikistan and Uzbekistan, with a view to further deepening and expanding mutually beneficial cooperation in such areas as trade, investment, finance, transport and communication. The national development strategies of the five CACs – including Kazakhstan’s “Path to the Future”, Tajikistan’s “Energy, Transport and Food” (a three-pronged strategy aimed at revitalising the country), and Turkmenistan’s “Era of Might and Happiness” – all share common ground with the SREB’s objectives. Furthermore, at the third China-Central Asia Cooperation Forum held in Shandong, in June 2015, a commitment to “jointly building the Silk Road Economic Belt” was incorporated into a joint declaration signed by China and the five CACs.

Central Asia: A Trading Partner for Hong Kong and the Chinese Mainland

Investment, and therefore improvements in energy and transport infrastructure, under the BRI are expected to boost CACs’ trade, particularly with other Belt and Road economies such as Hong Kong and the Chinese mainland. The resultant trade facilitation will therefore allow CACs to better realise the advantages their resources give them and to increase and diversify their trade in terms of export/import destinations and product variety.

In terms of trade, Kazakhstan is the No.1 Central Asian trading partner of both Hong Kong and the mainland. In 2014, the country accounted for 57% of Hong Kong’s trade with Central Asia and 50% of the mainland’s trade with Central Asia. Also noteworthy is that all the five CACs are overwhelmingly export destinations, rather than sources of imports, for Hong Kong. The pattern is repeated for the mainland, except as regards Turkmenistan.

Product-wise, nearly 90% of Hong Kong’s exports and imports to and from Central Asia in 2014 involved electronics/electricals or related parts and components. A further breakdown shows that Hong Kong’s trade with Central Asia is predominantly concentrated on telephone sets, computers and related parts and components. This is largely due to the fact that more and more Chinese, Russian and even European telecommunications equipment companies have set up production facilities in Central Asia in order to take advantage of cheaper production costs and proximity to markets in Eastern Europe and West Asia, giving rise to a high demand for related inputs.

With respect to the mainland, the trade portfolio is much more diversified. Major exports to Central Asia in 2014 included apparel and clothing accessories (representing 22% of the total), electronics/electricals and related parts and components (21%), footwear (13%), vehicles other than railway or tramway rolling-stock, and parts and accessories (5%), and articles of iron or steel (5%). In the other direction, the mainland’s imports from Central Asia in 2014 were mainly energy resources and commodities, including mineral fuels (representing 71% of the total), chemicals and compounds of precious/rare-earth metals (9%), copper (6%), and ores, slag and ash (6%).

Central Asia: An Investment Destination for Hong Kong and the Chinese Mainland

Prior to any increase in investment stemming from the implementation of the BRI, Kazakhstan is by far the largest recipient of outward direct investment (ODI) from the Chinese mainland, while no significant investment flows between Hong Kong and CACs have so far been tracked. In 2014, Kazakhstan accounted for 75% of the mainland’s ODI in Central Asia, followed by Kyrgyzstan (10%) and Tajikistan (7%). In terms of industrial distribution, oil, gas and metals receive the lion’s share of the mainland’s ODI in Central Asia, while infrastructure projects such as roads, railways and pipelines are also attracting investment.

To better encourage foreign investment, all CAC governments have committed to improving their respective business environments, but some have been more successful than others. For instance, the government in Kazakhstan has targeted a reduction in the time required to register a business from ten days to one hour, while the paperwork needed for customs procedures and other business operations is to be cut by 60%. The country has also extended and expanded its visa-free entry scheme for a number of countries in order to boost tourism and foreign investment. Furthermore, a US$3 billion stimulus package in 2015-17, part of the country’s latest five-year economic plan, is aimed at investment priorities such as the development of the transport and logistics sectors, and improvement works on utility networks and energy infrastructure, foreshadowing greater ease and better prospects of doing business.

Tajikistan ranked low in terms of ease of doing business in 2015 but its array of business reforms include the implementation of new software at a one-stop shop for public service delivery and the further simplification of business registration procedures. These changes led it to rank as the top improver out of 189 economies surveyed.

Turkmenistan, however, does not even have an ease of doing business ranking for international investors to assess its business environment. This indicates that foreign investment is rare in the country but also that there is a clear lack of accurate and comprehensive information on different sectors. This makes market entry not only difficult, but also highly risky.

A Closer look at the Five “Stans”

As a regional giant, the size of the Kazakh economy is almost double that of the other four CACs combined. As a more advanced economy, Kazakhstan also leads in purchasing power, which was nearly 50% higher than the first runner-up, Turkmenistan, and 10 times bigger than the least-ranked, Tajikistan. As the region’s second most populous country, Kazakhstan’s average GDP growth rate between 2009 and 2014 was, however, only about half that of Turkmenistan (10.3%), and ahead of only Kyrgyzstan (3.6%) in the region.

Thanks to its significant mineral reserves of oil, natural gas, coal, chrome, lead, tungsten, copper, zinc, iron and gold, Kazakhstan is an important world energy supplier. Processing of metals and steel production are also leading industries in the country. Combined with other smaller manufacturing sectors such as the production of machines, chemicals and food and beverages, industry accounts for about a third of GDP. The rest of the economy is mainly comprised of construction and agriculture, as well as an extensive but mostly small-scale service sector that includes wholesale/retail trade, real estate, finance and insurance.

As an important component in the BRI, Kazakhstan has been striving to upgrade and modernise its logistics and trade infrastructure. Aside from various oil-and-gas pipelines, the passages of the Yuxinou Railway linking Chongqing with Duisburg, Germany and the Chengdu-Europe Express Railway linking Chengdu and Lodz, Poland, the free trade zone developing on the border crossing at Khorgas, on the Kazakh-Chinese border, is expected to open huge prospects for transit of cargo through Kazakhstan.

Together with the Zhetygen-Khorgas and Jezkazgan-Beineu railway lines, the Western Europe-Western China motor road corridor, and the port of Aktau on the Caspian coast, this infrastructure represents a wide array of logistics and distribution options for traders across the region. Meanwhile, expected WTO membership in early 2016 will provide traders with further relief on customs duties and import barriers, making the country an even more attractive transit point for Asian/European-bound cargo and centre for regional distribution.

The economy of the region’s most populous country, Uzbekistan, meanwhile remains highly bound up with the growing and processing of cotton, fruits, vegetables and grain (wheat, rice and corn). Aside from being a world leader on reserves of gas, coal and uranium, Uzbekistan was also the sixth-largest producer and the fifth-largest exporter of cotton in the world in 2014. However, such industries as automotive (General Motors began production of Chevrolets in November 2008, for example), agricultural machinery manufacturing, biotechnology, pharmaceuticals and information technology have increased in importance over the years since independence in August 1991.

Following the signing of an agreement with China in June 2015 regarding the extension of economic cooperation under the framework of the BRI, bilateral cooperation in such sectors as business, transportation and telecommunication will increase between China and Uzbekistan, while bulk stock trading, infrastructure construction and industrial park projects will also be developed. The rapid development and extension of railway and road networks in Uzbekistan, including the 19-kilometre railway tunnel connecting the capital city, Tashkent, with the populous Ferghana Valley, is an early sign of success.

Blessed by large budget surpluses stemming from the exploitation of energy sources and commodities such as gas (abundant gas deposits lie underneath the Karakum Desert – including the Galkynysh gas field, which has the second-largest volume of gas in the world, after the South Pars field in the Persian Gulf), Turkmenistan has the worst record of economic and trade liberalisation among the former republics of the Soviet Union. Unlike countries such as Kazakhstan and Kyrgyzstan, which have rapidly reformed their economies in a more marketoriented direction, Turkmenistan has stuck to a “national way of development” and put less effort into modernising.

As a result, Turkmenistan’s participation in the world economy remains very low, even when compared to its Central Asian neighbours. Not only has Turkmenistan not presented its candidature to the WTO, it is also not a prospective AIIB founding member, the only exception among the five CACs.

In addition to various energy production sharing agreements (PSAs) with the Chinese mainland, Russia and Germany, the gas-rich country has announced plans to boost its gas output and is seeking ways to diversify its portfolio of export markets to encompass Belt and Road countries such as China and Iran, via new pipelines. In line with President Gurbandguly Berdymukhamedov’s leadership and declaration of an “Era of Might and Happiness”, the BRI is poised to give the country new incentives to reach out to other economies along the Belt and Road, including the Chinese mainland, notably in the transportation and infrastructure sectors.

Rich in antimony, aluminium, gold and silver and having substantial hydropower and agricultural (cotton and wheat) potential, Tajikistan is the poorest country in terms of per-capita GDP among the five CACs, thanks in part to its challenging geographic location – 90% of its territory is covered by mountains, with half being 3,000 metres above sea level. Its southern border with Afghanistan often adds uncertainty to the business environment as terrorism and drug trafficking are a menace. NATO’s withdrawal from Afghanistan last year poses a further threat to the country’s stability as the possibility of a spillover of unrest and terrorist activity from Afghanistan increases.

Close ties with Russia notwithstanding, Tajikistan’s trade with China has been increasingly vibrant in recent years, with Chinese enterprises staffing many infrastructure projects, including the Sahelistan Tunnel and Tajik-Uzbek Highway, as well as various resource extraction projects. Thanks to growing Chinese investments, the impoverished state broke its annual production record for cement and increased gold output by roughly 25 percent in 2014.

To revitalise the economy, the Tajik government has set three strategic goals in relation to energy independence, advancement in transport networks and food security. These national goals resemble most if not all of those of the BRI. In particular, more resources are expected to be pumped into the development of telecommunications, transportation and electricity networks. Meanwhile, better use of available infrastructure can make the nation attractive not only for businesspeople, but also leisure travellers. After all, thanks to its varied landscape and dramatic geographical features, Tajikistan was named No 2, behind Malta, in travel guide Globe Spots’ top-10 list of countries to travel to in 2014.

Heavily reliant on the production and export of gold, mercury, natural gas, uranium and agricultural products such as cotton, meat, tobacco, wool and grapes, Kyrgyzstan is a mountainous country with one-third of its population living below the poverty line. Due to its mountainous landscape, livestock farming has a prominent position in the country’s agricultural economy, which also boasts a vibrant food processing industry consisting of sub-sectors encompassing sugar, fruits, vegetables, meat, milk and oil.

Billed as the eastern door to Central Asia, Kyrgyzstan has been a WTO member since 1998. The relatively long tradition of adopting laws according to WTO regulations has helped Kyrgyzstan comply with international standards of trade and business. Furthermore, in May 2015 Kyrgyzstan signed a law ratifying treaties on the country’s accession to become the fifth member of the Kremlin-led Eurasian Economic Union (EAEU). It finally acceded in August 2015, and customs control at eight checkpoints along the Kyrgyz-Kazakh border have been abolished.

Jump-starting Trade and Investment with Central Asia

Situated in Central Asia, deep in the Eurasian continent, Kazakhstan occupies an area of some 2,724,900 km2. It is not only the biggest landlocked country and largest Central Asian economy in terms of geographical territory and GDP, but a good platform and partner for Hong Kong companies to tap into the Central Asian market under the umbrella of the BRI.

As a strategically important player under the BRI, Kazakhstan has signed a series of agreements (33 co-operation agreements worth US$23.6 billion in March 2015 and 25 agreements worth US$25 billion in September 2015) on closer cooperation in various sectors such as railway, electricity, nuclear energy and agriculture. Observing the growing impetus, many Chinese and other Asian companies (such as South Korean companies) have established operations in Kazakhstan.

The country, along with Kyrgyzstan, Tajikistan and Uzbekistan, is a founding member of the Asia Infrastructure Investment bank (AIIB), which is expected to play a pivotal role in supporting the development of infrastructure and other productive sectors, including energy and power, transportation and telecommunications, rural infrastructure and agriculture development, water supply and sanitation, environmental protection, urban development and logistics in the region.

In order to overcome volatility in global energy prices and create a stronger base for economic growth, President Nursultan Nazarbayev announced in November 2014 a new economic plan. "Path to the Future" puts infrastructure development top of the country’s list of priorities. Aside from sizeable infrastructural projects including road, rail and special economic zones, there will also be financial support worth KZT100 billion tenge (US$0.5 billion) for SMEs, creating some 4,500 additional jobs as well as incentives for Kazakh companies to internationalise.

For the time being, Kazakhstan is the only CAC with a consulate office in Hong Kong. This, together with reciprocal 14-day visa-free status for HKSAR and Kazakh passport holders, makes business connections between the two economies far easier than with other CACs. In addition, direct flights (twice a week on Tuesdays and Fridays) between Hong Kong and Almaty – the largest city in Kazakhstan and its key business city – give the country a further advantage over other CACs in terms of being Hong Kong’s first port of call in Central Asia.

Moreover, some Kazakh companies have chosen to list in Hong Kong. Kazakhmys PLC, a leading natural resource group and the first Kazakh company to list on the London Stock Exchange, listed in Hong Kong in 2011, while its marketing and logistics arm also relocated to Hong Kong from London in October 2012. The country’s imminent WTO membership in early 2016 is poised to trigger stronger trade and investment flows to and from Kazakhstan, and will provide a wealth of opportunities in international logistics and financial services for Hong Kong companies.

[1] Intra-regional trade share refers to the percentage of intra-regional trade to total trade of the region. A higher share indicates a higher degree of dependency on regional trade.

economists-pick-research.hktdc.com, 19.11.2015